Think of the stock market as the big, beating heart of India’s money system. It’s grown a lot over the years and helps people buy and sell things like shares of companies. This market is super important because it helps figure out how healthy India’s economy is, kind of like a doctor checks your heartbeat.

This article is like a treasure map that shows you around the Indian stock market. We’ll explore two major places: the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE). These are like the main control centers where all the action happens.

Whether you’re just curious about how people make money from stocks or want to understand how these big exchanges work, I’ll guide you through it step by step. By the end of this, you’ll see how these markets help make money for people and even help our country grow. So, let’s get started and dive into the exciting world of stocks in India!

What is the Stock Market?

The stock market is like a giant supermarket for buying and selling pieces of companies. These pieces are called “stocks” or “shares.” When you own a stock, it means you own a small part of that company. In India, this market is not just one place but includes several different locations where people can buy and sell stocks.

A Quick Look at History

The idea of trading stocks in India isn’t new; it’s been around for a long time! The very first stock exchange in India started in the 1850s under a tree where people would gather to buy and sell shares. Over time, this informal gathering turned into the Bombay Stock Exchange (BSE) in 1875, making it one of the oldest in Asia. Later, in 1992, the National Stock Exchange (NSE) was founded, which introduced electronic trading. This means people could buy and sell stocks using computers, making everything faster and more efficient.

Major Stock Exchanges in India

In India, the two biggest stock markets are the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE). The BSE is like an old, wise leader because it’s the oldest in Asia and has a lot of experience. The NSE, although newer, quickly became important because it uses a lot of modern technology, making trading easier and faster for everyone.

Both these markets help people invest their money in different companies, from big ones that everyone knows to smaller ones that are just starting out. By investing in these companies, people hope to make more money as the companies grow and succeed.

Key Components of the Indian Stock Market

The Indian stock market is like a big supermarket, but instead of buying groceries, people buy and sell different types of money-related items. Let’s explore some of the things and people you find in this financial supermarket:

1. Stocks, Bonds, and Derivatives:

- Stocks: Imagine you could buy a tiny piece of a big company like Apple or Samsung. That tiny piece is called a “stock.” When you own a stock, you own a small part of that company. If the company does well, the value of your tiny piece can go up! Let’s say you buy 10 shares of a company like Tata Motors at ₹100 each, spending a total of ₹1,000. If Tata Motors does well and their stock price rises to ₹150 per share, your 10 shares are now worth ₹1,500. You’ve made a profit of ₹500 just because the company performed well!

- Bonds: Think of a bond as a loan you give to a company or the government. In return, they promise to pay you back with a little extra as a thank you for using your money. Imagine you lend ₹10,000 to the government by buying a bond. The government promises to pay you back with interest. If the bond has a 5% interest rate per year, after one year, you’ll get ₹10,500 back. That extra ₹500 is the thank you for letting them use your money.

- Derivatives: This is a tricky one. Derivatives are like making a bet on what will happen with stocks or bonds. People use them to protect themselves from prices going up and down too much or to try to make extra money from their guesses. Let’s understand this by a simple hypothetical example: you think a cricket bat that costs ₹1000 will be ₹1200 next month because it’s popular. Using a derivative, you make a deal to buy it next month for ₹1100. If the price really goes up to ₹1200, you only pay ₹1100 as per your deal. So, you saved ₹100 because you guessed the price would go up!

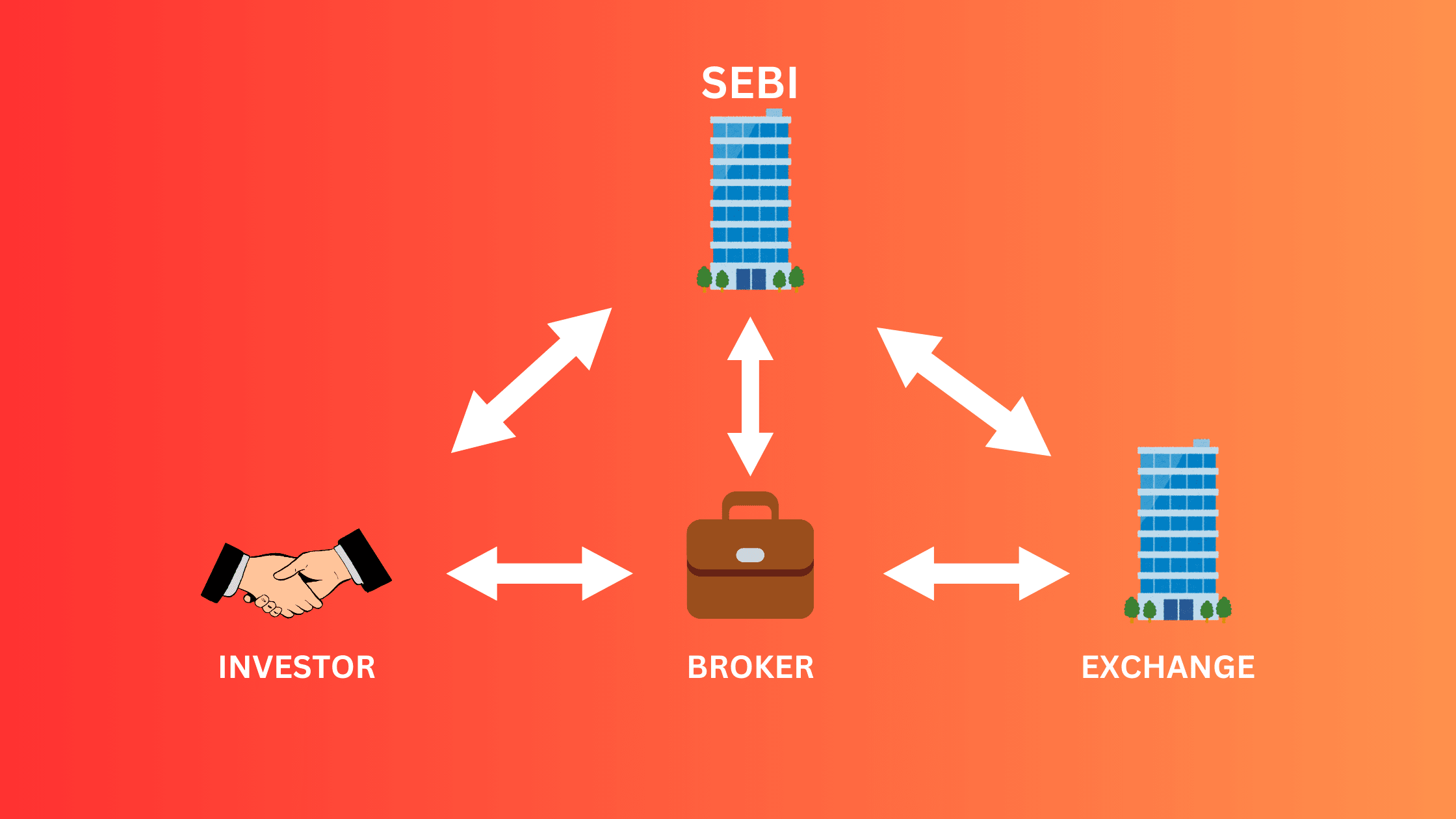

2. Market Participants:

- Stockbrokers: These are the people who help you buy or sell stocks. You tell them what you want to do, and they make it happen in the market.

- Retail Investors: Regular people like you and me who buy and sell stocks. They might be saving for college or planning for a big purchase.

- Institutional Investors: These are big players like banks or insurance companies. They have a lot of money to invest, and they buy large amounts of stocks or bonds.

3. Regulatory Framework – SEBI:

- The Securities and Exchange Board of India (SEBI) is like the principal of the stock market school. They make the rules to make sure everyone plays fair. SEBI watches over everything to make sure no one cheats or does anything sneaky. They help keep the market safe for everyone, making sure that the companies whose stocks are being bought and sold are telling the truth about their business.

Understanding these key components helps you see how the Indian stock market works like a well-oiled machine, with lots of parts and people all working together to make it run smoothly.

How the Stock Market Works in India

1. How Companies Get Listed on the BSE or NSE

Imagine you created a lemonade stand and wanted to let other people invest money in it so you can grow bigger. Listing on the Bombay Stock Exchange (BSE) or the National Stock Exchange (NSE) is somewhat similar for big companies. First, the company tells the public all about their business through something called an Initial Public Offering (IPO). This is like announcing, “Hey, you can buy a part of my company!” Then, they follow lots of rules set by the market regulators to make sure everything is fair. Once everything is checked and approved, their company’s name and shares appear on the stock exchange, and people can start buying and selling them.

2. Trading Process: How Orders Are Executed

Trading stocks is like trading Pokémon cards. You decide which card (or stock) you want to trade, find someone who wants what you have, and make a deal. In the stock market, this happens electronically. When someone wants to buy or sell stocks, they put in an ‘order’ through their computer. This order goes to the stock exchange, where a system looks for other people’s orders that match up. For example, if you want to buy 10 shares of a company at a certain price, the system finds someone willing to sell 10 shares at that price. When a match is found, the trade is made, and the details are recorded.

3. What Are Market Indices? Sensex and Nifty 50

Market indices, like the Sensex and Nifty 50, are like scoreboards that show how well the stock market is doing. The Sensex includes 30 big companies from the BSE, and the Nifty 50 has 50 big companies from the NSE. By looking at these indices, you can tell if the overall market is going up or down. It’s like checking a leaderboard in a video game to see who’s winning; these indices give investors a quick idea about whether most stocks are gaining or losing value.

4. Primary and Secondary Markets

The primary market is where companies first sell their shares to the public through an IPO, like our lemonade stand example. It’s their debut in the stock market. After that, these shares move to the secondary market, which is where everyone else starts buying and selling the shares among themselves. The company isn’t involved in these trades anymore. It’s like when you sell your video game to a friend, and then your friend sells it to someone else.

Benefits and Risks of Investing in the Indian Stock Market

1. Making Money with the Stock Market

Imagine if you could own a tiny part of a big company, like the ones that make your favorite snacks or games. When you invest in the stock market, that’s exactly what you’re doing—you’re buying small pieces of companies. If these companies do well and make money, you make money too! Over time, many people have grown their savings by investing in stocks because as the value of these companies grows, so does the value of your small part.

2. The Risks: Things to Watch Out For

However, just like a cricket game where anything can happen, investing in the stock market can be unpredictable. Sometimes, the prices of stocks go up and down very quickly, which is what adults call ‘market volatility.’ There are also rules that change sometimes, which can make the market act differently. This means that while you can make money, you can also lose it if the companies you’ve invested in don’t do well or the rules change in a way that affects them.

3. Playing It Safe: Diversification and Understanding Market Cycles

To play it safe, smart investors use what’s called ‘diversification.’ This is just a big word for not putting all your eggs in one basket. Instead of buying stocks from just one company, they spread their money across different kinds of investments, like different types of companies or other ways to save money. This way, if one investment doesn’t do well, the others might still be doing fine, which keeps their money safer.

Another smart move is understanding ‘market cycles.’ This means recognizing that sometimes the market is up (like a high tide) and sometimes it’s down (like a low tide), and planning your investment accordingly. By understanding these patterns, investors can better predict when to buy more stocks or when to hold off.

Conclusion

We’ve just taken a cool journey through the Indian stock market, learning all about how it works and why it’s so important. Remember, this market is where people buy and sell parts of companies, and it helps everyone understand how well our country’s economy is doing.

But learning about the stock market isn’t just a one-time thing—it’s like a superpower that grows the more you use it! Keep exploring and asking questions about how money works and how to make smart choices when investing. This knowledge is not just about making money; it’s about making wise decisions that can help you and our whole country in the future.

So, think of the stock market as a big tool that helps build people’s dreams and our country’s future. The more we know about it, the stronger and smarter we can become together!

2 thoughts on “What is Stock Market?”