Flipkart, one of India’s largest e-commerce platforms, has been at the center of investors’ attention for several years. With its impressive growth and acquisitions, many are curious about Flipkart share price, even though the company is not yet publicly listed on Indian stock exchanges like the BSE or NSE. In this article, we will explore everything you need to know about Flipkart’s share price, its IPO potential, its share price chart, and the factors influencing its valuation. Whether you’re a beginner or a seasoned investor, this information will help you make better decisions regarding Flipkart shares.

Understanding Flipkart’s Share Price and IPO Prospects

Currently, Flipkart is unlisted, meaning it is not yet available to trade on public exchanges like BSE or NSE. However, this has yet to dampen interest, as investors keenly await its much-anticipated IPO, which is projected to take place soon.

If you want to know more about stock market and how you it works, you can go through this post: What is stock market?

IPO Share Price Expectations

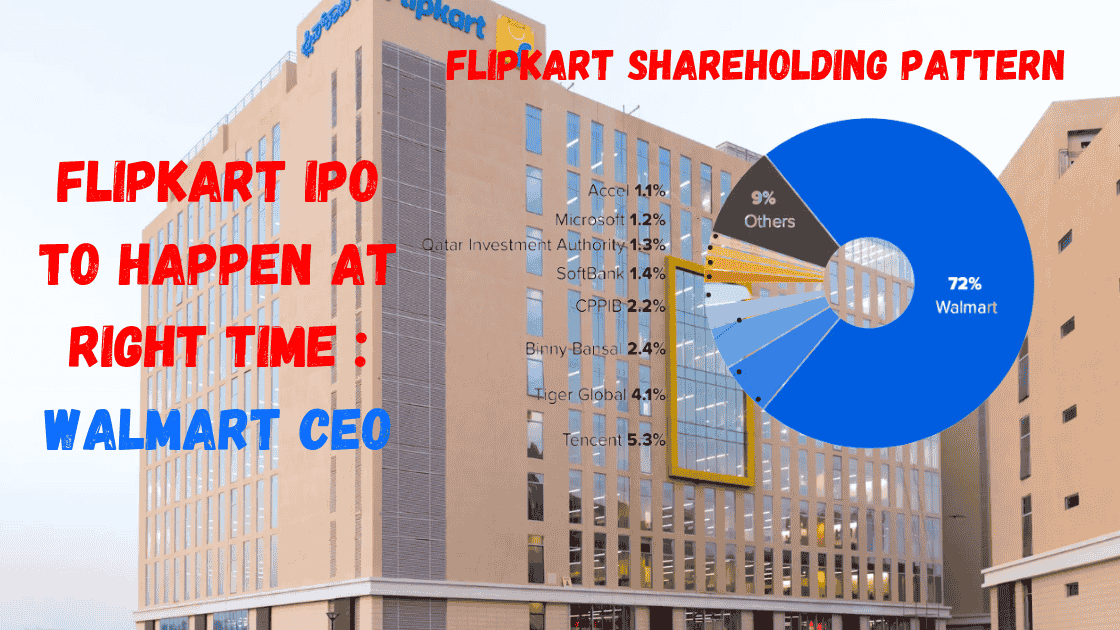

Flipkart’s IPO is expected to debut in the U.S., with analysts estimating a valuation between $60 and $70 billion. This valuation reflects Flipkart’s leadership in India’s rapidly growing e-commerce market. It’s important to note that these IPO shares, when listed, will provide new opportunities for both retail and institutional investors to capitalize on Flipkart’s growth.

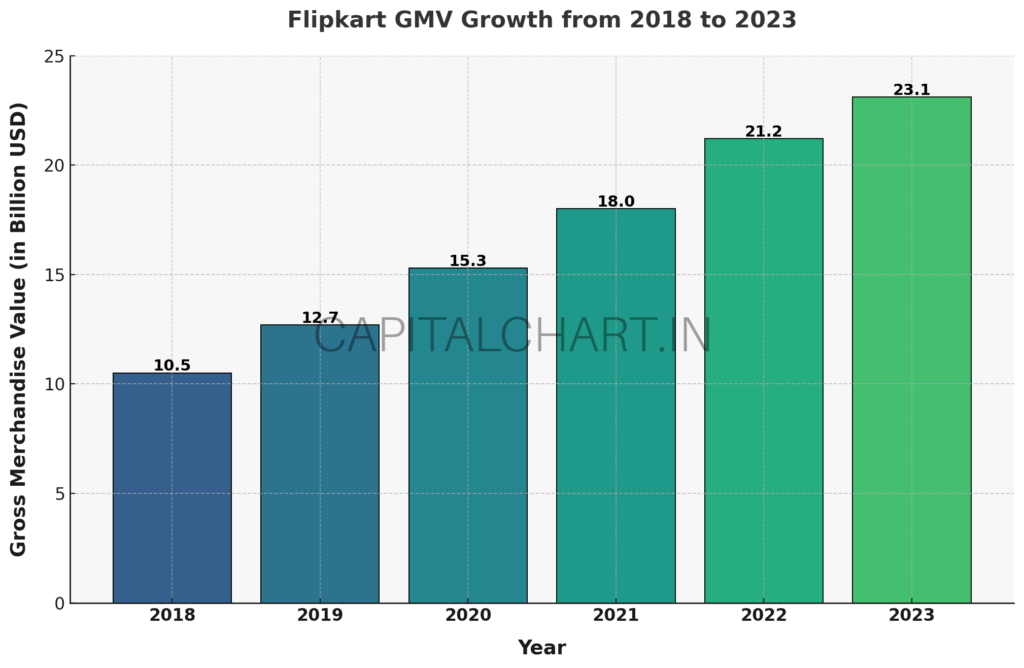

Historical Growth and Valuation

Flipkart has experienced a meteoric rise since its inception. Walmart’s acquisition of a 77% stake in 2018 for $16 billion significantly enhanced its valuation. Despite a devaluation caused by the separation of its payment arm, PhonePe, Flipkart’s current valuation remains robust at around $35-$40 billion.

Flipkart Share Price Chart and Factors Affecting It

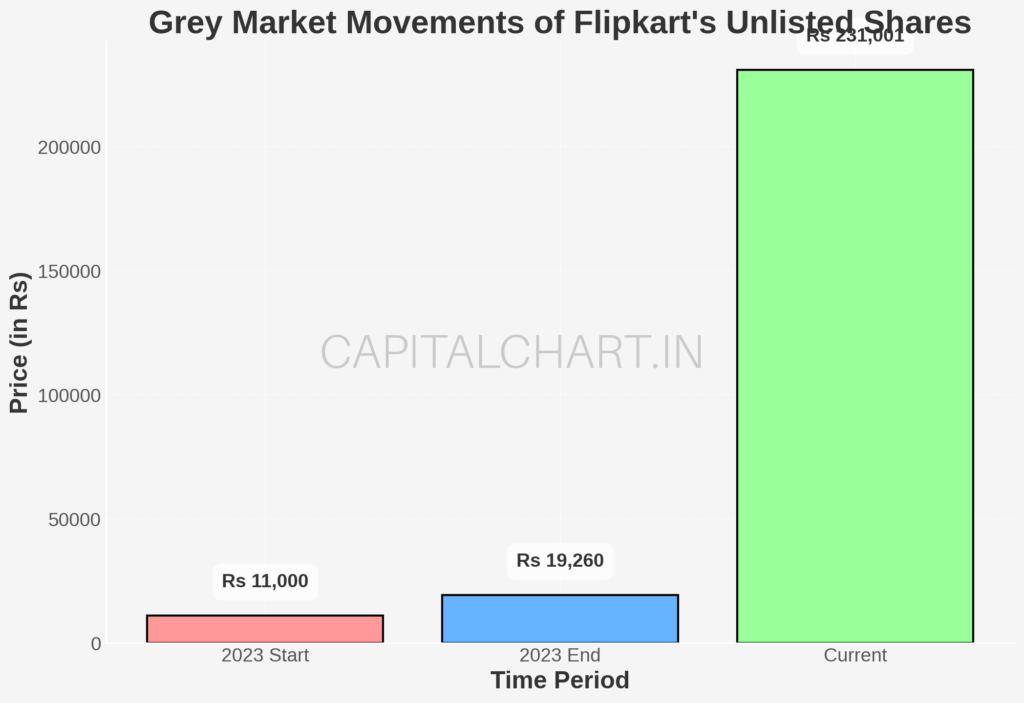

Although no public Flipkart share price chart is available yet, investors can observe trends in its valuation from private equity and grey market movements.

Grey Market Movements

In the Indian grey market, Flipkart’s unlisted shares have consistently risen. For instance, in 2023, the unlisted Flipkart share price jumped from Rs. 11,000 to nearly Rs. 19,260. Currently, the grey market price of Flipkart shares is around Rs 2,31,001 per equity share, driven by solid growth prospects and market dominance.

What Influences Flipkart’s Share Price?

Several factors influence Flipkart’s valuation:

- Acquisitions: Strategic acquisitions, such as Myntra, Ekart, and Cleartrip, have significantly bolstered Flipkart’s market reach.

- Competition: Flipkart’s main competitors include Amazon, Meesho, and other rising players like JioMart. Its ability to outperform these rivals will play a key role in driving up its stock price.

- Regulatory Challenges: Changes in e-commerce regulations in India, including tighter control over foreign investments, could impact Flipkart’s growth trajectory and, by extension, its share price.

- IPO Speculation: Positive anticipation surrounding Flipkart’s IPO will also likely influence the grey market valuation of its unlisted shares.

Strategies for Beginners to Invest in Flipkart Shares

- Invest in Unlisted Shares: Although risky due to limited liquidity and valuation transparency, investing in unlisted Flipkart shares via platforms that specialize in pre-IPO stocks can provide early entry into this e-commerce giant.

- Walmart Shares: An alternative for investors looking to benefit indirectly from Flipkart’s success is to buy shares of Walmart, which owns a majority stake in Flipkart. Walmart’s financial performance is closely linked to Flipkart’s growth in India.

- Watch the IPO Launch: Stay updated on Flipkart’s potential IPO, as this event will allow retail investors to buy shares at the initial offering price, which could lead to significant gains if the company performs well post-listing.

- Diversify Your Portfolio: While Flipkart presents a promising opportunity, it is advisable to diversify investments across sectors to minimize risk.

FAQs About Flipkart Share Price

- What is Flipkart’s current share price? As of now, Flipkart is not publicly listed, so there is no Flipkart share price available on exchanges like BSE or NSE. However, its grey market price is approximately Rs 2,31,001 per equity share.

- When will Flipkart have its IPO? Flipkart’s IPO is expected to launch soon, likely in the U.S., with a projected valuation between $60 and $70 billion.

- Can I buy Flipkart shares on BSE? No, Flipkart shares are not currently listed on the Bombay Stock Exchange (BSE) or any other public stock exchange.

- How can I invest in Flipkart before its IPO? You can purchase its unlisted shares through private equity platforms. However, these investments come with higher risks due to liquidity issues and market volatility.

- What factors influence Flipkart’s share price? Significant factors include its financial performance, competition in the Indian e-commerce market, regulatory policies, and market sentiment ahead of its IPO.

In conclusion, Flipkart share price remains a point of significant interest, despite the company’s current unlisted status. Investors looking to benefit from Flipkart’s massive growth should monitor developments surrounding its IPO, keep an eye on grey market trends, and consider alternative investment routes such as Walmart shares. As Flipkart gears up for its public market debut, staying informed and ready to act will be critical to capitalizing on this opportunity.

For more updates on Flipkart share price, IPO timelines, and other investment opportunities, subscribe to our newsletter or consult with a financial advisor for personalized advice.

1 thought on “Flipkart Share Price Prediction: What Investors Need to Know”