Tata Motors is a key player in India’s automotive industry, and with the company’s shift toward electric vehicles (EVs) and international expansion, investors are eager to understand its long-term potential. This article dives into the Tata Motors share price target for 2030, leveraging financial trends, market dynamics, and expert projections to provide actionable insights for traders and long-term investors alike. Whether you’re a beginner or seasoned investor, this guide will offer clear strategies and data-backed predictions to help you make informed decisions.

By 2030, Tata Motors’ share price could benefit from several growth drivers. We will break down these factors in detail :

Growth Drivers Behind Tata Motors’ Share Price Target for 2030

1. Electric Vehicle (EV) Expansion

Tata Motors is leading the EV revolution in India, with plans to derive 25% of its total sales from electric vehicles by 2025. With an aggressive approach to EV infrastructure, driven by its subsidiary Tata Power, Tata Motors is set to benefit from India’s push toward green mobility. Currently, it commands more than 70% of the domestic EV market, putting it in an ideal position for sustained growth in the coming decade.

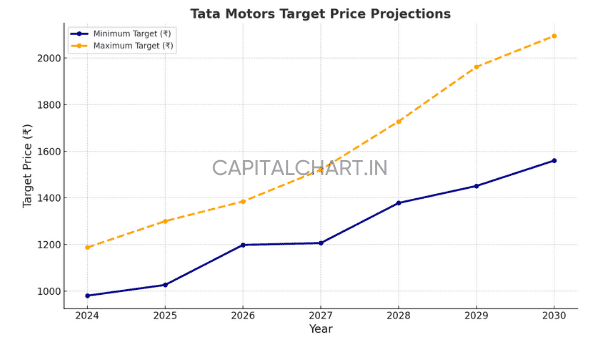

Key Prediction: Experts predict that Tata Motors share price could range from ₹1,560 to ₹2,095 by 2030 due to its dominant position in the EV market.

2. Global Market Expansion

Tata Motors is leveraging its global brand Jaguar Land Rover (JLR) to expand into key international markets, including China and Europe. The success of JLR’s new EV models and its localization strategy in China is crucial to driving both volume and profitability. Moreover, the company is aligning itself with global trends by investing in next-gen technologies such as connected and autonomous vehicles.

Investor Tip: Tata Motors’ global expansion could provide significant returns for long-term investors, particularly if the company successfully capitalizes on EV growth in China and Europe.

3. Financial Strength and Debt Reduction

Tata Motors’ financial health has seen marked improvement, which could positively influence its share price. For example, the company reduced its net debt by ₹8,000 crores in FY22, and its debt-to-equity ratio fell from 1.24 to 0.99 over the past year. Prudent capital allocation and improved cash flows strengthen the company’s ability to invest in future growth.

Projected Impact on Share Price: These financial improvements, coupled with rising revenues from new product launches, could push the Tata Motors share price target toward ₹2,095 by 2030.

4. Technological Innovation

Tata Motors is investing heavily in advanced technologies like autonomous driving, connected vehicle solutions, and alternative fuel technologies. These innovations will not only help the company stay competitive but also drive new revenue streams. The development of EV charging infrastructure through Tata Power further enhances the company’s long-term prospects.

5. Strong Brand and Market Share

Tata Motors’ commanding presence in India’s automotive sector, particularly in passenger vehicles and commercial vehicles, provides a solid foundation for future growth. The introduction of new products, such as the Tata Tiago EV, will help maintain this strong position while tapping into emerging market demands.

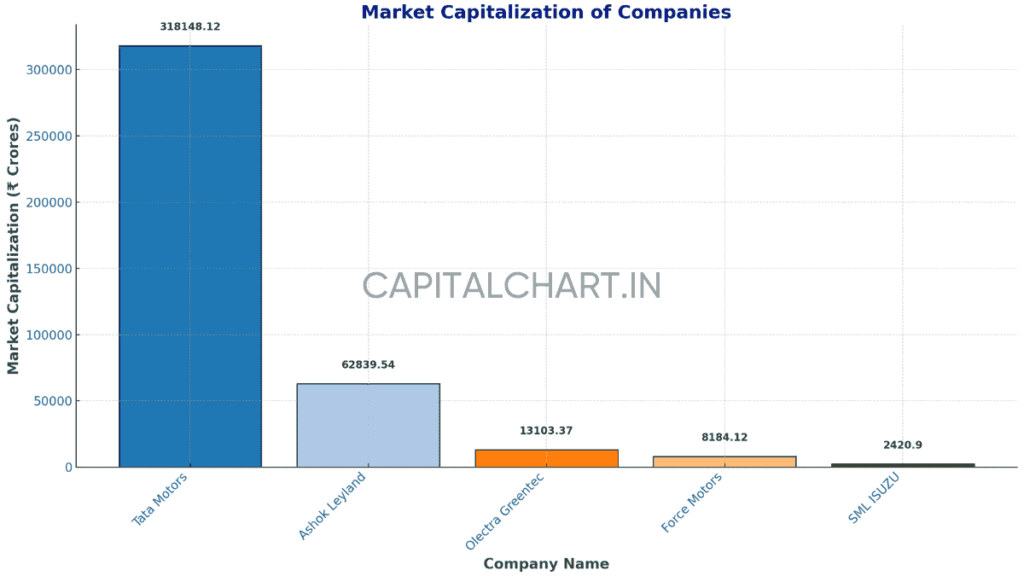

6. Tata Motors Peer Comparison

Tata Motor Quarterly Performance

- Sales Trends:

- Tata Motors’ quarterly sales show a positive trend, moving from ₹66,406 crore in June 2021 to ₹119,986 crore in March 2024. Sales peaked in recent quarters, consistently exceeding ₹100,000 crore since March 2023, indicating strong growth momentum.

- Expenses:

- Quarterly expenses have risen alongside sales, from ₹61,164 crore in June 2021 to ₹102,851 crore by March 2024. However, the rate of expense growth has been comparatively controlled, especially in recent quarters, suggesting effective cost management.

- Operating Profit and Margin (OPM%):

- Operating profit has shown variability, with significant peaks such as ₹17,135 crore in March 2024. Operating Profit Margins (OPM%) have strengthened, improving from a low of 3% in June 2022 to 15% in June 2024, reflecting enhanced profitability and operational efficiency.

- Other Income:

- Other income fluctuates each quarter, with notable highs in June 2022 at ₹2,381 crore. In recent quarters, it has stabilized between ₹1,500 and ₹1,700 crore, contributing positively to overall profitability.

- Profitability and Performance Indicators:

- Tata Motors’ performance indicators, notably the increasing OPM%, highlight a positive trend in profitability. The gradual improvement in profit margins reflects Tata Motors’ capacity to leverage growth while managing costs effectively.

This data-oriented analysis underlines Tata Motors’ upward solid trajectory, especially in terms of sales and profitability, positioning the company well for sustained growth(source)

Potential Risks to Consider

Even with these growth drivers, some risks remain. Supply chain disruptions, particularly for semiconductors, could limit production capacity and sales volumes. Additionally, Tata Motors will need to navigate increasing competition from both domestic and international players like Mahindra and Hyundai, especially in the EV segment.

Tata Motors Share Price Target 2030: Breakdown

Based on various analyses and expert opinions, here’s a year-by-year breakdown of Tata Motors share price targets leading up to 2030:

| Year | Minimum Target (₹) | Maximum Target (₹) |

| 2024 | 980.20 | 1,187.15 |

| 2025 | 1,026.18 | 1,300.00 |

| 2026 | 1,198.00 | 1,384.50 |

| 2027 | 1,206.00 | 1,520.00 |

| 2028 | 1,378.00 | 1,728.00 |

| 2029 | 1,451.00 | 1,962.00 |

| 2030 | 1,560.00 | 2,095.00 |

You may like:

Flipkart unlisted share price

:

:

Investment Strategies for Tata Motors in 2030

For new investors, Tata Motors offers an excellent long-term investment opportunity. Here are a few strategies to consider:

- Long-Term Holding: With Tata Motors leading India’s EV transition, holding the stock for at least 5-10 years could yield significant returns. Investors should focus on the company’s performance in the EV sector and international markets.

- Diversified Portfolio: Include Tata Motors as part of a diversified portfolio to balance risk. As the automotive industry is prone to cyclical changes, diversification can help mitigate losses during downturns.

- Averaging Investment: For beginner investors, buying the stock in intervals (dollar-cost averaging) is a solid strategy to reduce the impact of market volatility.

Cons of Investing in Tata Motors

Even with substantial growth prospects, there are risks involved:

- Supply Chain Issues: The ongoing global semiconductor shortage could significantly impact production.

- Competition: Increased competition in the EV space, especially from Mahindra, Hyundai, and global EV giants like Tesla, may pressure Tata Motors to innovate faster.

- Macroeconomic Risks: Tata Motors’ global operations expose it to risks such as fluctuating currency rates and regional economic downturns.

Frequently Asked Questions (FAQs)

1. What is the Tata Motors share price target for 2030?

Based on expert analysis, the Tata Motors share price is expected to be between ₹1,560 and ₹2,095 by 2030, supported by its expansion in electric vehicles and strong global performance.

2. How will Tata Motors benefit from the EV revolution?

Tata Motors is already leading India’s EV market, holding over 70% of the market share. Its partnerships with Tata Power to develop charging infrastructure further boost its prospects in this sector.

3. Is Tata Motors a good long-term investment?

Yes, due to its diversified product portfolio, strong market presence, and leading role in India’s EV transition, Tata Motors is considered a strong candidate for long-term investment.

4. What are the key risks for Tata Motors?

Key risks include supply chain disruptions, particularly semiconductor shortages, and increased competition in the electric vehicle market.

Why Tata Motors is a Strong Contender for 2030

Tata Motors has positioned itself as a market leader, particularly in the EV segment. With strong financial management, innovative technological advancements, and a significant focus on sustainability, the company is poised for substantial growth. Investors should consider the long-term potential of Tata Motors share price targets for 2030, with predictions indicating a price range between ₹1,560 and ₹2,095.

For those considering an investment, now may be the perfect time to start building a position in Tata Motors for long-term gains.

Disclaimer and Advisory Note for Investors:

Investing in stocks always carries risks. The predictions provided are based on current trends and expert analysis, but they are not guaranteed. Investors should conduct their own research and consider consulting with a financial advisor before making investment decisions. Remember, past performance is not indicative of future results.

Before investing in any asset please read the SEBI report: SEBI Study

1 thought on “Tata Motors Share Price Target 2030: A Data-Driven Forecast”