The IRFC Share Price Target is a critical focus for investors seeking to understand the potential growth and risks of the Indian Railway Finance Corporation (IRFC) in the coming years. As a government-backed financial institution, IRFC plays a key role in funding the Indian Railways, an essential part of the country’s infrastructure. Understanding its share price target can help investors make informed decisions about their investment strategy.

In this article, we will delve deep into the IRFC Share Price Target for the years 2025 to 2030, providing a comprehensive analysis that includes both fundamental and technical factors. We will explore the company’s financial performance, key market indicators, and how broader economic factors might influence its stock price. Additionally, we’ll provide detailed predictions for each year and address the most frequently asked questions from investors.

Fundamental Analysis

1. Revenue Growth: The revenue of IRFC has been on a steady incline, primarily due to the expansion and modernization of India’s railway infrastructure. In recent years, IRFC’s revenue growth has been supported by large-scale financing projects, including those related to electrification, track doubling, and the purchase of rolling stock for Indian Railways. As these projects continue to grow in scale, IRFC’s revenue is expected to rise in the coming years.

For example, in FY 2024, IRFC reported a revenue of ₹6,763 crore, with a slight growth of 0.4% year-over-year from ₹6,736 crore in FY 2023. As the government continues to invest heavily in rail infrastructure, IRFC’s revenue is likely to see a consistent increase.(source: BajajBroking)

2. Profit Margins: Profit margins for IRFC have generally been stable, with the company maintaining a solid return on investment due to its role as the primary financier for Indian Railways. The company’s focus on large-scale, long-term projects has allowed it to maintain healthy margins, even during periods of economic slowdown. Moving forward, IRFC is likely to benefit from economies of scale as its portfolio of financed projects grows, potentially improving profit margins.

3. Earnings Per Share (EPS): EPS has been a key indicator of IRFC’s profitability and growth potential. The company’s EPS saw a 2.5% increase in FY24, reaching ₹1.25 per share. This is expected to continue rising as IRFC scales up its financing and diversifies into new sectors, including renewable energy and metro infrastructure.

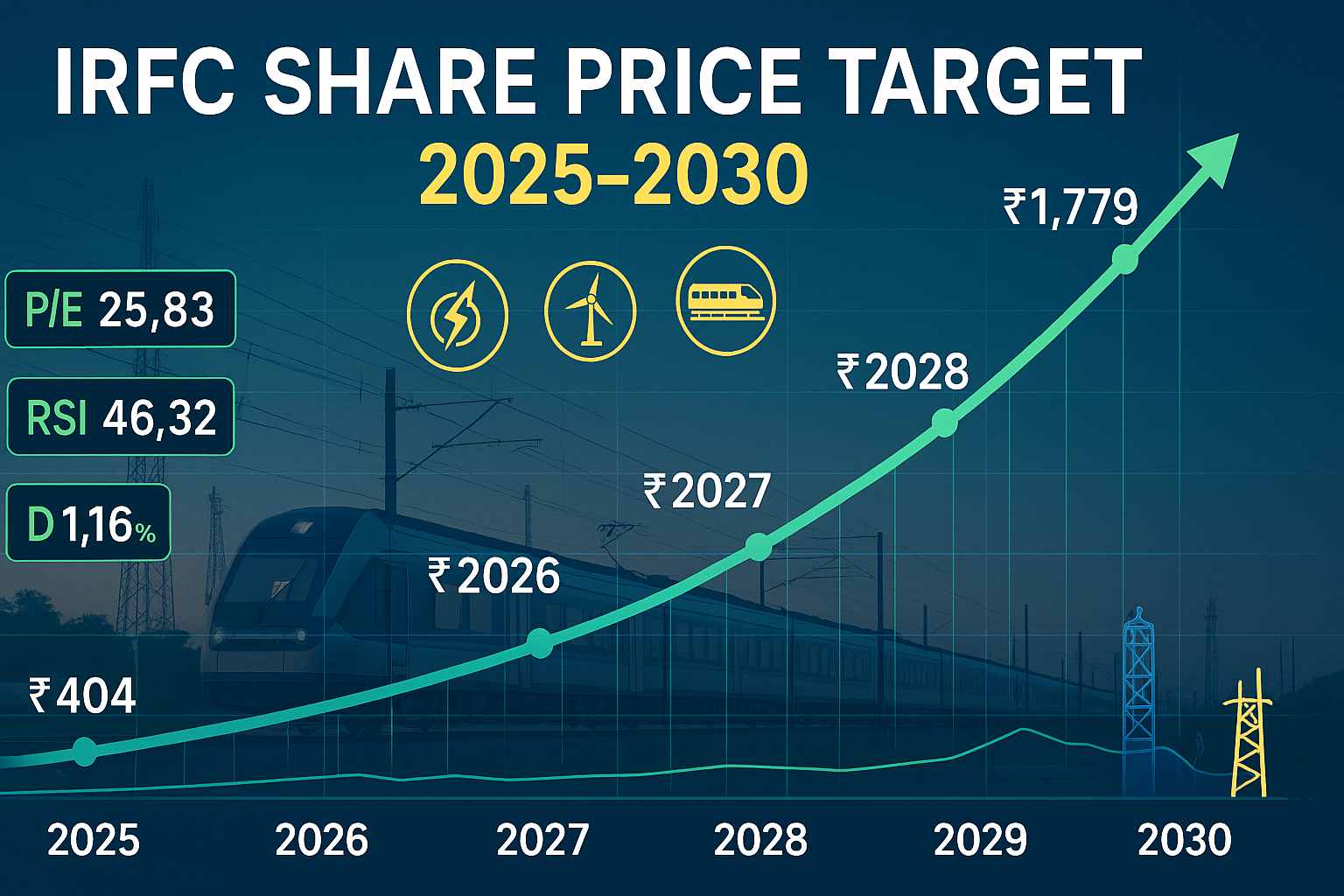

4. Price-to-Earnings Ratio (P/E): As of April 2025, IRFC’s P/E ratio is approximately 25.83, suggesting that the stock is slightly above the industry average. This indicates that investors are willing to pay a premium for IRFC’s stable earnings and government backing. A P/E ratio in this range is common for companies in the financial services sector that have reliable cash flows and a high level of market confidence.

5. Dividend Yield: IRFC offers a relatively attractive dividend yield of around 1.16%, which is a key feature for long-term investors looking for stable returns. The dividend payout is expected to remain steady as the company’s financials continue to strengthen due to its government-backed operations and increasing revenue streams from infrastructure financing.

6. Debt Levels and Their Impact on Share Price: IRFC’s debt-to-equity ratio stands at 7.81 (as of Q3 FY24), down from 8.69 in FY23. This decline indicates improved financial leverage and a reduction in borrowing costs. The company’s ability to maintain manageable debt levels is crucial for its share price stability, as high levels of debt can be a concern for investors. However, given IRFC’s role in financing government projects and its stable cash flows, its debt remains relatively well-managed compared to other financial institutions.

Technical Analysis

1. Moving Averages:

-

Short-Term (5-day SMA): ₹125.47

-

Medium-Term (50-day SMA): ₹126.67

-

Long-Term (200-day SMA): ₹123.14

As of April 2025, the stock is positioned above the 200-day SMA, signaling a positive long-term trend. However, the stock is trading slightly below the 50-day SMA, indicating a short-term pullback in prices.

2. Resistance and Support Levels:

-

Resistance Level (Short-Term): ₹132.80

-

Support Level (Short-Term): ₹123.42

The stock has tested resistance near ₹132.80, with support found around ₹123.42. A break above the resistance could signal a further bullish trend, while failure to hold above support may lead to a short-term decline.

3. Relative Strength Index (RSI):

-

The 14-day RSI for IRFC is at 46.32, indicating that the stock is neither overbought nor oversold. The stock is in a neutral zone, which suggests there is room for potential upward momentum, especially if broader market conditions remain favorable.

4. Bollinger Bands:

-

Upper Band: ₹130.00

-

Lower Band: ₹119.00

-

IRFC’s price is currently near the lower band, which can indicate that the stock is oversold and could be due for a potential reversal upward, especially if it breaks above the middle band.

Market and Economic Factors

1. Government Policies and Regulations: Government infrastructure spending is a key driver for IRFC’s business model. With the Indian government’s push for modernization and sustainability in the railway sector, IRFC is well-positioned to benefit from continuous infrastructure projects. Policies that increase railway electrification, the development of new high-speed trains, and metro projects will directly impact IRFC’s portfolio of financed projects.

2. Interest Rates: Interest rate changes by the Reserve Bank of India (RBI) will have a direct impact on IRFC’s borrowing costs. A rise in interest rates would increase financing costs, putting pressure on profit margins. However, a lower interest rate environment, as we are currently experiencing, would enable IRFC to borrow at cheaper rates, thereby improving profitability and potentially boosting its stock price.

3. Performance of the Indian Economy: The performance of the Indian economy plays a significant role in the financial outlook for IRFC. Strong economic growth, particularly in the infrastructure sector, would lead to higher demand for IRFC’s services. Conversely, any slowdown in economic activity could delay infrastructure projects and slow down IRFC’s revenue growth.

4. Global Market Conditions: Global economic conditions, such as fluctuations in commodity prices, trade policies, and the strength of the Indian Rupee, can also impact IRFC’s performance. A stronger global economic outlook could increase foreign investment into India, while a weaker global economy might lead to lower investor confidence.

IRFC Share Price Target 2025-2030

2025 Target: ₹404.86 – ₹454.32

2026 Target: ₹554.78 – ₹643.74

2027 Target: ₹702.36 – ₹834.83

2028 Target: ₹851.83 – ₹1,029.03

2029 Target: ₹1,149.84 – ₹1,402.51

2030 Target: ₹1,446.82 – ₹1,779.88

Each of these targets is based on IRFC’s projected revenue growth, strong market position, and increasing government infrastructure spending. Additionally, the technical factors like moving averages, support, and resistance levels point to positive long-term growth, making these targets realistic based on current trends.

Frequently Asked Questions (FAQs) on IRFC Share Price Target

1. What is the expected IRFC share price target for 2025?

The expected IRFC share price target for 2025 is between ₹404.86 and ₹454.32. This projection is based on the company’s steady growth and government-backed infrastructure financing.

2. How does IRFC compare to other stocks in the finance sector?

IRFC offers a unique advantage with its focus on infrastructure financing, backed by the Indian government. Its P/E ratio is higher than some competitors, but its stability and government-backed operations make it an attractive investment.

3. Is IRFC a good investment for long-term growth?

Yes, IRFC is a strong candidate for long-term growth, given its central role in India’s infrastructure development and its stable financials. However, investors should consider risks such as market volatility and changes in interest rates.

4. What factors influence IRFC’s share price?

IRFC’s share price is influenced by government policies, interest rates, economic conditions, and the company’s financial performance, particularly in relation to infrastructure development and railway financing.

Conclusion

In summary, the IRFC Share Price Target for 2025-2030 shows steady growth, with projections ranging from ₹404.86 in 2025 to ₹1,779.88 by 2030. Government infrastructure investments, stable financials, and favorable market conditions support this positive outlook.

While the stock presents rewarding opportunities, investors should remain cautious of risks like interest rate fluctuations and policy changes. Stay informed on IRFC’s performance by following regular updates, and make strategic investment decisions accordingly.