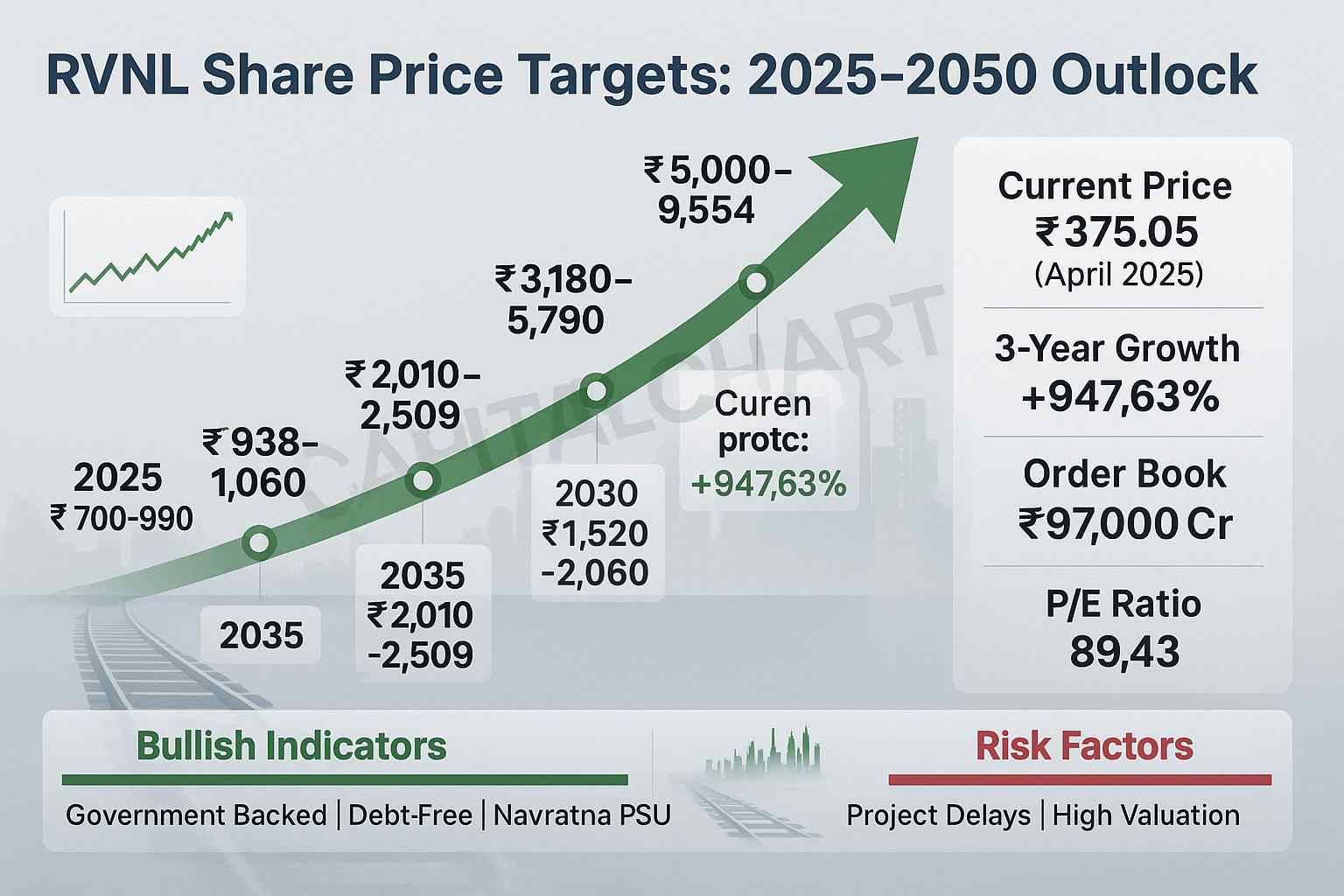

RVNL share price target 2025, RVNL share price target 2026, RVNL share price target 2030, RVNL share price target 2035, RVNL share price target 2040, RVNL share price target 2050—these are the buzzwords for investors eyeing Rail Vikas Nigam Limited (RVNL), a powerhouse in India’s railway infrastructure sector. If you’re wondering where RVNL’s stock is headed, you’re in the right place! This article dives deep into RVNL’s future, blending technical analysis, fundamental insights, and market trends to give you a clear picture. With India’s railway sector booming, RVNL is poised for big things. Stick around—it’s gonna be an exciting ride!

Why RVNL? A Quick Look at the Company

Rail Vikas Nigam Limited, established in 2003, is a Navratna PSU under the Ministry of Railways, Government of India. RVNL focuses on building and upgrading railway infrastructure—think new tracks, electrification, metro projects, and high-speed rail corridors. It’s like the backbone of India’s railway modernization! With a massive order book and government backing, RVNL is a darling of long-term investors.

But what makes RVNL special? It’s not just about laying tracks. The company’s debt-free status (thanks to government support) and diverse project portfolio set it apart. From metro rail in cities like Bangalore to international ventures in the Middle East, RVNL is everywhere. Plus, its stock has delivered multibagger returns, soaring 947.63% over three years, compared to the Nifty 100’s modest 37.57% [Economic Times]. That’s the kind of growth that makes investors sit up!

Fundamental Analysis: RVNL’s Financial Muscle

Let’s break down RVNL’s financials to see why it’s a solid bet for RVNL share price target 2025 and beyond.

Revenue and Profit Trends

RVNL’s financials are like a train picking up speed. In FY2024, the company reported:

-

Revenue: ₹20,225 crore, up from ₹17,581 crore in FY2023.

-

Net Profit: ₹1,249 crore, with a steady profit margin of around 5–6%.

-

Order Book: A whopping ₹97,000 crore as of March 2025, with over 50% tied to railway projects.

However, Q1 FY2025 showed a hiccup—a 35% drop in net profit to ₹224 crore and a 27% revenue decline to ₹4,047 crore [EquityTime]. Why? Delays in project execution and seasonal fluctuations. But don’t panic! RVNL’s long-term growth is intact, driven by India’s infrastructure push.

Key Financial Ratios

-

Return on Equity (ROE): Averaged 18% over five years, showing efficient use of shareholder funds.

-

Debt-to-Equity Ratio: 0.99, nearly debt-free as the Ministry of Railways services liabilities.

-

Price-to-Earnings (P/E) Ratio: 89.43, high but justified by growth prospects .

-

Dividend Yield: 0.64%, with a consistent payout (₹2.11 per share in 2024).

Market and Sector Context

India’s railway sector is on fire! The government plans to invest ₹2.4 lakh crore in railways by 2027, with projects like Dedicated Freight Corridors and Vande Bharat trains leading the charge [Ministry of Railways]. RVNL, as a key player, benefits directly. The infrastructure sector grew 8.2% in 2024, outpacing the broader market’s 5.6% [NSE India]. With urbanization and freight traffic rising, RVNL’s growth aligns with India’s economic boom.

Nugget: Did you know RVNL’s order book is so big it could build a railway from Delhi to Dubai? That’s the scale we’re talking about!

Technical Analysis: Charting RVNL’s Path

Technical analysis helps us predict RVNL share price target 2025 and beyond by studying price patterns and indicators. Let’s dive into the charts!

IDFC First Bank Share Price Target

Current Price and Trends

As of April 21, 2025, RVNL’s share price is ₹375.05 [Economic Times]. It’s down from a 52-week high of ₹647 but up 3.79% in the last month. The stock is trading below its 200-day moving average, signaling short-term bearishness but long-term potential.

Key Technical Indicators

-

Relative Strength Index (RSI): At 49.61, it’s neutral, neither overbought nor oversold.

-

Moving Averages: The 50-day MA (₹350) is below the 200-day MA (₹400), indicating a cautious trend.

-

Support and Resistance:

-

Support: ₹300–305, a strong base where buyers step in [INDMoney].

-

Resistance: ₹385–388, a level to watch for a breakout.

-

Price Patterns

RVNL’s chart shows a bullish flag pattern forming, suggesting a potential upward breakout in 2025. The stock’s 270.30% growth in the last year proves its volatility and reward potential. If it breaks above ₹388, we could see a rally toward ₹500 by mid-2025.

Nugget: RVNL’s stock once jumped 60% in just 15 days in 2024 . Talk about a rollercoaster!

RVNL Share Price Target 2025: Month-by-Month Forecast

Here’s our detailed RVNL share price target 2025 forecast, based on technical and fundamental analysis. We expect steady growth driven by new project wins and government spending.

|

Month |

High (₹) |

Low (₹) |

|---|---|---|

|

January |

496.10 | 450.00 |

|

February |

505.76 | 460.00 |

|

March |

520.00 | 470.00 |

|

April |

550.00 | 490.00 |

|

May |

569.24 | 510.00 |

|

June |

600.00 | 530.00 |

|

July |

620.00 | 550.00 |

|

August |

650.00 | 580.00 |

|

September |

710.00 | 620.00 |

|

October |

780.24 | 680.00 |

|

November |

850.21 | 740.00 |

|

December |

990.00 | 860.00 |

Average Target for 2025: ₹700–750

Key Drivers: New orders worth ₹10,000 crore expected in H1 2025, plus metro and electrification projects.

RVNL Share Price Target 2030: Month-by-Month Forecast

Fast forward to RVNL share price target 2030. With India aiming to be a $5 trillion economy, RVNL’s role in high-speed rail and metro expansion will be massive.

|

Month |

High (₹) |

Low (₹) |

|---|---|---|

|

January |

1,317.94 | 1,200.00 |

|

February |

1,350.00 | 1,220.00 |

|

March |

1,400.00 | 1,250.00 |

|

April |

1,457.56 | 1,300.00 |

|

May |

1,500.00 | 1,350.00 |

|

June |

1,550.00 | 1,400.00 |

|

July |

1,612.70 | 1,450.00 |

|

August |

1,700.00 | 1,520.00 |

|

September |

1,800.00 | 1,600.00 |

|

October |

1,950.00 | 1,750.00 |

|

November |

2,000.00 | 1,850.00 |

|

December |

2,060.00 | 1,900.00 |

Average Target for 2030: ₹1,520–1,612

Key Drivers: High-speed rail corridors and international projects in Saudi Arabia.

Long-Term Outlook: RVNL Share Price Target 2026, 2035, 2040, 2050

RVNL Share Price Target 2026

-

Expected Range: ₹938.15–₹1,060.81

-

Why? RVNL’s order book is projected to hit ₹1.2 lakh crore, with metro projects in Tier-2 cities and railway electrification driving growth .

RVNL Share Price Target 2035

-

Expected Range: ₹2,010–₹2,509

-

Why? India’s railway network will expand to 150,000 km by 2035, with RVNL leading metro and freight corridor projects . Global partnerships, like with Deutsche Bahn, will boost revenue.

RVNL Share Price Target 2040

-

Expected Range: ₹3,180–₹5,790

-

Why? By 2040, India aims to be a global infrastructure leader. RVNL’s focus on green energy (solar-powered rail) and international contracts will fuel growth .

RVNL Share Price Target 2050

-

Expected Range: ₹5,000–₹9,554

-

Why? As India becomes a superpower, RVNL’s role in smart cities and high-speed rail will be unmatched. Analysts predict a CAGR of 15–20% for PSU railway stocks by 2050 .

Nugget: RVNL’s joint venture with IRCON for a ₹115.79 crore electrification project in 2025 is just the tip of the iceberg. Imagine what’s coming in 2050!

Risks to Watch

No stock is risk-free, and RVNL is no exception. Here are some hurdles that could impact RVNL share price target 2025 and beyond:

-

Project Delays: Land acquisition issues or bureaucratic red tape can slow execution .

-

Economic Slowdowns: A dip in government spending could hit RVNL’s order flow.

-

Competition: Private players entering the infrastructure space may pressure margins.

-

Market Volatility: RVNL’s high P/E ratio makes it sensitive to market corrections.

Pro Tip: Diversify your portfolio to balance RVNL’s risks. A mix of PSU and private infra stocks can be a smart move.

Why Invest in RVNL? The Bull Case

Here’s why RVNL is a must-consider for RVNL share price target 2025 and long-term investors:

-

Government Support: As a Navratna PSU, RVNL gets priority for mega projects.

-

Strong Order Book: ₹97,000 crore ensures revenue visibility for years.

-

Multibagger Potential: Past returns of 2,500% in five years show its firepower .

-

Global Expansion: Partnerships in Saudi Arabia and solar projects diversify income.

Nugget: RVNL’s work on the Pamban Bridge, safe for 100 years, shows its engineering prowess. That’s a stock you can trust!

FAQs on RVNL Share Price Target

1. What is the RVNL share price target for 2025?

The RVNL share price target 2025 is expected to range between ₹700 and ₹990, driven by new orders and railway modernization .

2. Is RVNL a good long-term investment?

Yes! RVNL’s strong fundamentals, government backing, and massive order book make it a solid pick for RVNL share price target 2030 and beyond.

3. What is the RVNL share price target for 2050?

Analysts predict RVNL share price target 2050 could hit ₹5,000–₹9,554, assuming India’s infrastructure boom continues .

4. Does RVNL pay dividends?

Yes, RVNL offers a dividend yield of 0.64%, with ₹2.11 per share paid in 2024 [Economic Times].

5. What are the risks of investing in RVNL?

Project delays, economic slowdowns, and high valuations are key risks for RVNL share price target 2025 .

Conclusion: All Aboard the RVNL Express!

RVNL is more than a stock—it’s a bet on India’s infrastructure future. From RVNL share price target 2025 at ₹700–990 to RVNL share price target 2050 at ₹5,000–9,554, the journey looks promising. With a rock-solid order book, government support, and technical signals pointing to a breakout, RVNL is a stock to watch. But stay cautious—market volatility and project risks are real.

Ready to invest? Do your homework, consult a financial advisor, and keep an eye on RVNL’s next big project. The railway revolution is just getting started, and RVNL is leading the charge!